The Child Tax Credit if a big fucking deal (TM)

Not as big as the legislation the president initially have that designation, but big, and nearly certain to be much more popular in its early stages:

Months into lockdown, Maggie Wiggin noticed that her 7-year-old son had become depressed. “Lockdown was a nightmare, I think, for a lot of special-needs kids. Just an incredibly difficult time,” she said, explaining that her son has autism. “And then he started getting sick.” His face began to swell, a sign of edema; his kidneys weren’t working. He spent time in the hospital, took what Wiggin describes as “unpleasant medicines,” and asked his parents if he was going to be okay. The trauma built up over time, and Wiggin, desperate to help him, was pleased when she discovered an effective therapy for her son called Floortime, for which a practitioner came into her home to work directly with her son. There was just one problem: Insurance wouldn’t cover it. The family, which includes her 4-year-old daughter, began to sink into credit-card debt. They felt that if they had a choice “between him being perpetually unhappy, and being in credit-card debt, that was an easy choice: to pay,” she said.

Then July 15 arrived and, with it, relief: Wiggin received $550 that Thursday morning, thanks to the expanded child tax credit. Wiggin said she had been checking for days in case the money had arrived. “Just to see if maybe it had come early. Then I opened up my bank account yesterday morning, and I got the biggest smile on my face,” she said. She immediately paid down her credit-card debt. Insurance still won’t cover her son’s therapy, but now it’s easier to afford. “I feel like there’s very few good news stories, and this is one,” she said.

For families like Maggie’s, the child tax credit expanded by President Biden and Democrats in Congress is both transformative social policy and rare good news after a year of incredible hardships. Families are to receive up to $300 per child under age 6 and $250 per child under age 18 every month through the end of the year. (The full credit is available only to couples who earn less than $150,000 and file taxes jointly.) Columbia University’s Center on Poverty and Social Policy has estimated that the tax credit, along with other poverty-reduction policies included in the American Rescue Plan, “could lift 5 million children out of poverty, cutting child poverty in half in the U.S.,” NPR reports. The policy breathes dramatic, if temporary, life into a welfare state sapped by decades of austerity-minded reforms. In its breadth, it also reveals the extent to which precarity has afflicted middle-class and impoverished households alike.

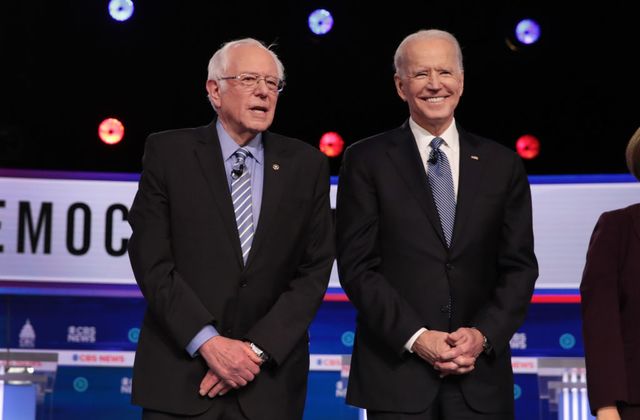

It should be emphasized, again and again, that zero members of the well-known hotbed of working-class socialism that is the Republican Party voted for this. Not one. This needs to be a persistent theme in 2020.