The Upcoming National Ripoff

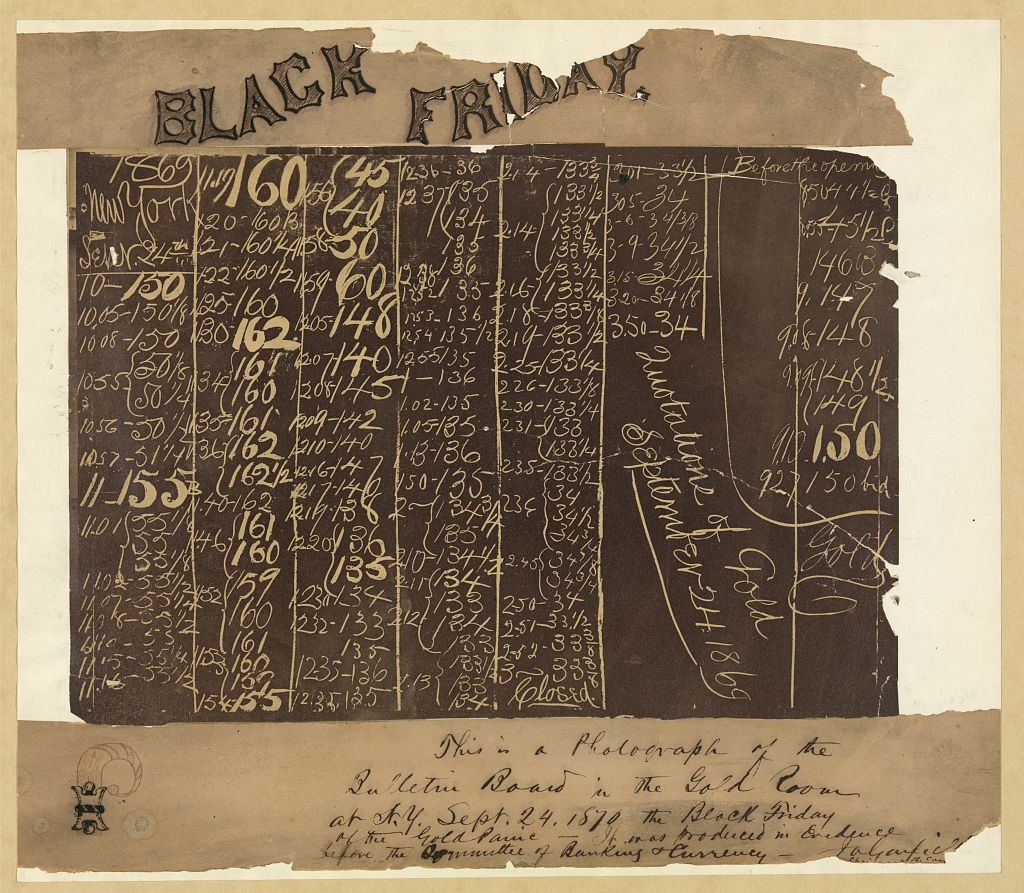

Ulysses S. Grant was a very stupid man when it came to financial matters. He legitimately thought that rich people were better than the rest of us and smarter too. So he would more or less do whatever rich guys wanted when he was president. He naivety led to Jay Gould, James Fisk, and his own brother in law attempting to corner the market in gold, nearly blowing up the nation’s economy in 1869. Then in 1873, their greed would in fact blow up the economy. Grant acted just in time in 1869, but never really got it.

Donald Trump is a very stupid man generally, albeit one with an otherworldly sense at how to channel other people’s resentments toward his own good. So I have little faith that he will do anything when his cryptobuddies come for the nation’s gold supply once again.

The crypto “industry” was one of the biggest spenders in the 2024 election. It practically single-handedly bought a U.S. Senate seat in Ohio, turfing out labor’s most reliable senator, Sherrod Brown, with $40 million in advertising. And it convinced Donald Trump to make a 180 with a big sack of campaign contributions. Back in 2021, Trump said crypto was a “scam,” but now he has his own coin, his media site is in discussions to buy a crypto exchange, and he’s fully bought into the claims that the industry is overregulated.

So now that crypto has bought great political influence, it’s time to cash in. How might this happen? The basic idea is to turn the American government into the biggest crypto bag-holder of all time. If the plan goes through, hundreds of billions of dollars of public assets will be spent or leveraged to buy a million Bitcoins, allowing the tiny minority of Bitcoin moguls to finally cash out their holdings into real money. It would be one of the biggest upward transfers of wealth in world history.

At the Financial Times, Toby Nangle explains the various plans. One idea is to loot the Exchange Stabilization Fund, which is largely under the president’s control, and has about $41 billion in net value. A much larger plan has been formally introduced by crypto shill Sen. Cynthia Lummis (R-WY). It’s called the (sigh) Boosting Innovation, Technology, and Competitiveness Through Optimized Investment Nationwide (BITCOIN) Act, and it identifies several public assets that might be drained. One idea is to reduce the capital reserve requirements at the Federal Reserve from $6.8 billion to $2.4 billion; another is to skim off the Fed’s $6 billion in annual money-printing profits.

But the biggest part of the program is to revalue America’s gold reserves. The U.S. government maintains a stockpile of about 261 million troy ounces of gold—or about 8,133 metric tons—in Fort Knox and other facilities. This is valued by statute at $42.22 per ounce, or $11 billion in total. But the market price of gold at time of writing is $2,631 per ounce. That’s more than 55 times as much, or a total of $688 billion.

Lummis proposes the Treasury issue new gold certificates based on the market price, and use the resulting cash—$677 billion at current prices—to buy up Bitcoins. In total, her bill would require the government to buy up 200,000 Bitcoins a year for five years, until a “strategic reserve” of a million would be accumulated.

Meanwhile, no one has yet explained to me why cryptocurrency should exist.