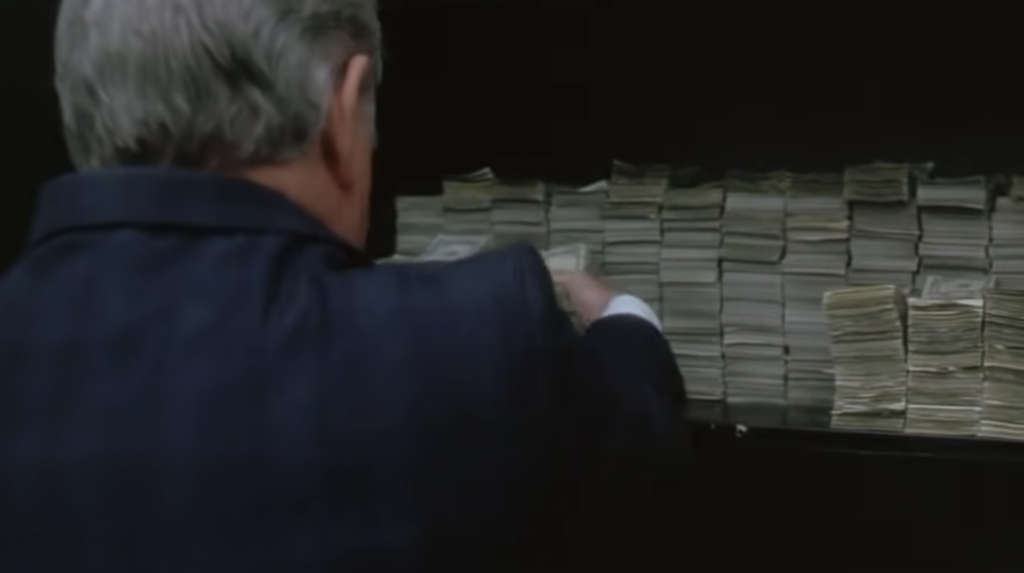

Looting a dysfunctional market

Allowing private insurance company executives to extract nice paydays from fly-by-night insurance companies that provide terrible service and then mostly go broke requiring the state to step in again is definitely Florida playing according to type:

But first, the Alabama-based hosts needed him to spell something out: If they too wanted to open up a carrier in the Sunshine State, they “could essentially take over a bundle” of policies from the state and then “those people would essentially get a letter saying, ‘Hey, you are now part of [the new] insurance company?’”

Yes, Lucas said. And then the former corporate attorney laid out how this system has enabled him to become one of the most successful and influential insurance executives in Florida.

“You get to cherry-pick the policies,” Lucas said, describing how he has been able to select hundreds of thousands of favorable policies — and the revenue that comes with them — from Florida’s state-run Citizens Property Insurance Corp. “You are underwriting and cherry-picking the best policies,” he added, “leaving kind of the worst ones there.”

In Florida, this is what’s known as a takeout, in which an insurer is able to assume thousands of policyholders and millions in premiums in one swoop, without fees or acquisition costs. Florida officials created the system about 30 years ago to try to shrink the exposure of Citizens, the state’s insurer of last resort, and attract new carriers after Hurricane Andrew sent major carriers scrambling.

That opportunity is what drew Lucas to the industry in 2012 when he created Heritage Insurance, and what’s behind Slide. He’s far from alone. Dozens of start-ups have flocked to the state over the years lured by the chance to grow big.

But while this system has been working for some top executives like Lucas, it has been crippling many residents and disaster victims, who are paying some of the highest prices in the nation for insurance while experiencing some of the worst claims handling and processing times, according to an investigation by The Washington Post. For many victims of last year’s catastrophic Hurricane Ian, the dysfunction has crushed their livelihoods, with scores still living in unfinished homes.

Over the past two decades, more than half of the carriers that participated in the “takeout” program have gone insolvent, state data shows. As climate-fueled hurricanes have repeatedly hit Florida in recent years, Citizens has picked up hundreds of thousands of new homeowners who otherwise couldn’t get insurance, fanning fears that the state-run insurer, with about half a trillion dollars of financial exposure, could need a U.S. taxpayer bailout.

Florida’s insurance market is one of the worst in the nation for homeowners, according to data from the National Association of Insurance Commissioners (NAIC) obtained by The Post. Overall, in 2022, Florida had the highest percentage of unpaid claims of any state and the most claims that were never processed, and it failed to renew the most policies.

As the system heads toward an inevitable bailout by the evil feds, it’s all about the golden parachutes we made along the way.