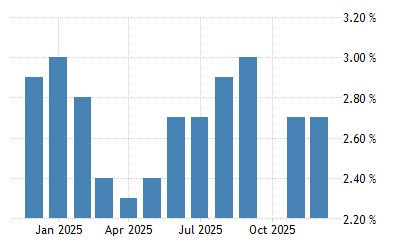

Inflation falls to 4% year over year

It’s always interesting to see how this kind of thing gets reported, as the inflation rate has been falling sharply for nearly a year now, but the year over year number wasn’t going to fall sharply until the big increases during the first half of 2022 fell out of the year over year calculation.

The consumer price inflation in the United States declined to 4.0 percent in May 2023, the lowest since March 2021 and slightly below market expectations of 4.1 percent, driven by a decline in energy prices. In addition, the core rate, which excludes volatile items such as food and energy, has slowed to 5.3 percent, the lowest since November 2021, supporting the argument for the Federal Reserve to consider pausing its current cycle of monetary tightening. Energy cost slumped 11.7 percent (vs -5.1 percent in April), while food inflation slowed to 6.7 percent (vs 7.7 percent in April). There were also smaller price increases for new vehicles (4.7 percent vs 5.4 percent), apparel (3.5 percent vs 3.6 percent), shelter (8.0 percent vs 8.1 percent), and transportation services (10.2 percent vs 11.0 percent). The cost of medical services was down 0.1 percent (vs 0.4 percent in April). On a monthly basis, consumer prices edged up 0.1 percent in May after increasing 0.4 percent in April.

In any event, here’s hoping that this will be enough to convince the Federal Reserve to stop raising interest rates.