Non-profits for multi-millionaires

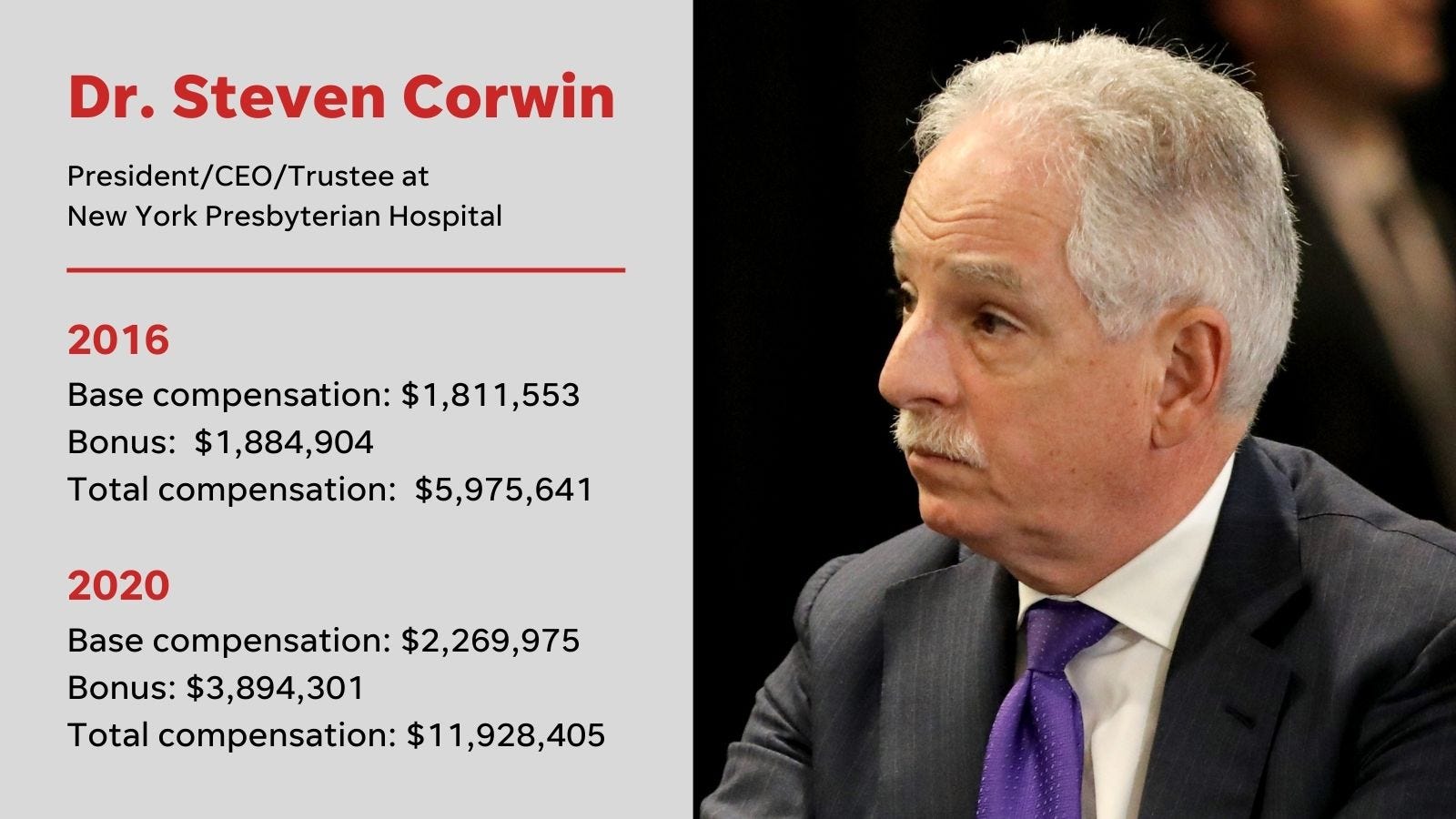

One remarkably unregulated aspect of the American tax system is that there seems to be essentially no limits on how much “non-profit” — that is, tax-exempt — organizations can pay people at the top of their compensation pyramids. This is particularly striking in the education and health care fields, which not coincidentally are the two areas of the economy in which costs have been going up fastest for many decades now.

Here’s a new study of hospital CEO compensation in North Carolina:

At Duke Health, for example, CEO Eugene Washington was making $1.2 million less in 2021 than his predecessor had been in 2010. But what those topline numbers do not reveal is Washington had doubled his compensation from his initial starting salary within four years. Some of the other examples were even more egregious: Atrium Health CEO Gene Woods more than quadrupled his salary in six years, and Mission Health CEO Ronald Paulus saw his paycheck grow by more than 700 percent in less than a decade.

Those pay increases for hospital leadership dwarfed the average growth nationwide in compensation for clinical staff like doctors and nurses. Family physician wages increased by 23 percent from 2010 to 2019; registered nurses saw their pay rise by just 15 percent over the same period.

According to the North Carolina researchers, the state’s nine largest nonprofit hospital systems paid 11 current or former CEOs a total of $38.7 million in 2019. That is equivalent to the salaries of 572 registered nurses, who were making about $68,000 on average in North Carolina that same year.

At the same time that hospital executives saw their salaries skyrocket, many of their facilities failed to provide the “community benefit” that is supposed to justify their nonprofit status. Patients who should have received charity care at North Carolina hospitals have instead been billed at least $150 million for medical services in recent years. In 2020, the state’s nonprofit health systems enjoyed $1.8 billion in tax breaks — but only one of them provided enough charity care to offset that tax exemption.

Taken together, the study paints a picture of hospital executives enriching themselves at the expense of vulnerable patients and overworked staff. The authors urged lawmakers to require transparency from all hospitals on executive compensation and stricter enforcement of the community benefit requirements that nonprofit facilities are supposed to abide by.

Basically, the ideology of the new Gilded Age is that the people at the top should be able to take everything that isn’t nailed down and half of what is, and this ethos permeates our “charitable” institutions just as much as it does the most rapacious for-profit corporation.