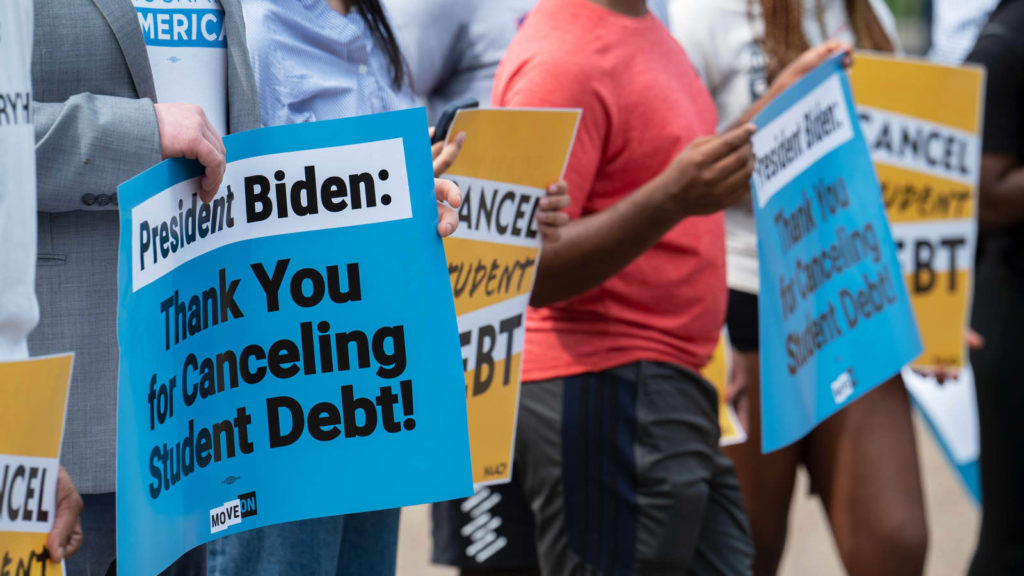

Who Biden’s debt relief plan helps

Not, contrary to popular claims, generally the rich:

Despite what critics may say, student loan debtors who stand to benefit most from the relief plan announced last week aren’t exactly latte-sipping elites.

Reality check: First, nearly 90% of those benefiting from the policy earn less than $75,000, according to the White House. Second, a significant percentage of student loan debtors didn’t get a four-year degree. That means they also don’t get the income boost of a bachelor’s degree.“Many Americans understandably, but mistakenly, assume that the vast majority of student loan debtors have 4-year degrees, when in fact about half do not,” said Aaron Sojourner, a labor economist at the Upjohn Institute.

Details: Sojourner looked at data for those who borrowed money and started college in 2011. He found that after six years, a majority didn’t have a bachelor’s:34% hadn’t attained a degree; 11% graduated from a two-year program; and 10% received a professional certificate, like from a trade school.

His data is in line with the White House estimates that nearly one-third of borrowers have debt but no degree.

It’s instructive to compare all the right and centrist hand-wringing over this with, say, the tax shelter for educational savings, which really does mostly benefit the rich, were made more expansive by Trump’s tax cuts, and does not face anything like the criticism of Biden’s debt relief. Make no mistake: the real problem with Biden’s plan is that too much of the benefit goes to the middle and working class, so it’s not “earned” like the mortgage interest deduction or tax benefits for real estate speculators.