Why does college cost so much?

This post is a deep dive into the question of how much money gets spent on higher education in America today relative to what was being spent prior to the beginning of New Gilded Age — forty years ago, roughly speaking — where that money is coming from, and who is getting what out of that expenditure. (Note that all dollar figures are expressed in constant, inflation-adjusted dollars).

Higher education in America will always to a large extent reflect what’s going on in the broader society, and what’s been going on in the broader society over the past forty or so years is an increasingly intense obsession with money, which in turn has produced increasingly grotesque levels of both consumerism and economic inequality.

Thus today we see things like the dean of the University of Miami’s law school, who was apparently quite popular with the school’s faculty, students, and alumni, getting fired by the university’s president after less than two years on the job, for what seems to be no other reason than the dean’s failure to raise “enough” money (Note that the dean’s abortive tenure was taken up almost wholly with managing the effects of a global pandemic on his institution. Note also that in characteristic fashion the president fired the dean after engaging in exactly zero consultation with the faculty, students, and alumni of the school).

This kind of thing is symptomatic. American universities are now run by the central administrative caste as quasi-businesses, and that means the only things that really count are growth and profit. Of course almost all these institutions are for the purpose of (not) paying taxes technically non-profits. This merely means operating profits are absorbed by internal stakeholders rather than external owners.

Preparatory to anything else, let’s get some widely held false beliefs out of the way.

False belief #1: College costs have gone up so much because higher education is no longer subsidized by the public to the extent it was formerly.

This is the favorite complaint/rationalization of university administrators. It’s almost wholly false, although it does contain a grain of truth, that is then distorted into a more general set of what turn out to be indefensible claims about why tuition has risen so much.

The grain of truth is that, since the baby boomers started arriving in college in the early 1960s, state appropriations for higher education have been on net largely flat in real dollar per student terms over this period as a whole, peaking in about the middle of that period, and currently standing about 14% below their historical high. (Per student state appropriations peaked at about $7716 in FY1990 and were approximately $6624 last fiscal year).

But what that fact obscures is that public subsidies for higher education in America are, again in real dollar per student terms, at an all-time high. Currently, the three largest forms of public subsidization for higher education are state appropriations, Pell grants, and federal tax credits (There are many more, but these are the biggest ones. Taking everything else into account would only underline that public subsidies for higher education have increased, not declined).

Here is the change over the course of the New Gilded Age in the per student real dollar public subsidy for students attending public institutions of higher education in America, expressed in terms of how much money is being sent to such institutions in the form of state appropriations, Pell grants, and federal tax credits:

FY1980: $7558

FY2020: $9017

Now these numbers obscure certain facts. The most important is that they don’t capture the far larger extent to which public subsidies for private colleges and universities have increased over the past four decades. Forty years ago, Pell grants were in their infancy, and federal tax credits for higher education costs didn’t exist. Public subsidies for private higher ed were largely limited to the tax deduction for gifts to such institutions — and levels of giving were much lower then than they became once the New Gilded Age really got going, and Jared Kushner had to be gotten into Harvard College one way or another etc.

Today, public subsidies to private colleges run into the many billions of dollars per year, which is a mostly unjustifiable use of public money, in a nation with thousands of public institutions of higher education.

A further question is the extent to which higher education should be publicly subsidized. Over the past 40 years, the percentage of total American GDP dedicated to higher education has increased by about 36%, from 2.2% to 3.0%. (Real per capita GDP has doubled over this time. College enrollment has increased by 63%).

But claims that America no longer funds higher education generously, or that it no longer subsidizes higher ed with public money as it did a generation or two ago, are simply false.

False belief #2: College costs have gone up much faster than most other costs because compensation for faculty is affected by Baumol’s cost disease, that is, the theory that salaries in areas with relatively low productivity growth must rise to compete with salaries in areas where technology has produced high productivity growth.

This explanation is offered again and again for why tuition keeps rising: Robots can build your car, but they can’t teach your child’s Intro to Psych class (yet). It’s a neat-sounding and intuitive little theory, whose only flaw is that it — at least in the context of the cost of college — remains completely unsupported by actual evidence.

In fact, salaries of full time college teachers have risen far more slowly than those of workers in general: the average full time college teacher today makes only 9.5% more than the average full time college teacher did 50 years ago, while the average wage of all American workers has increased by 35% over the same time frame. But the situation is actually far more dire than this: over this same time frame, the percentage of faculty that are full-time has fallen from almost 80% to around 55%. What this means — since temporary faculty are paid a tiny fraction of what full-time faculty are paid — is that the average teacher at an American institution of higher education is paid far less than than the average teacher was paid a half century ago, when the American economy was 60% smaller on a per capita basis than it is today!

In short, while a multitude of factors are driving the increase in college costs, increases in average faculty compensation are not one of those factors, given that such increases have not, on average, actually happened — indeed quite the opposite. Of course there are plenty of grotesque individual exceptions to this rule lurking in the virtual corridors of our finer professional schools, not to name names or anything. All right let’s name one just for the heck of it:

2019 Berkeley JOHN YOO PROF-AY-LAW 411,965.00 323,850.00 0.00

Those two figures are gross — le mot juste — pay, and regular pay, in case you’re wondering. OK there’s no need to torture these particular data any further, so moving right along:

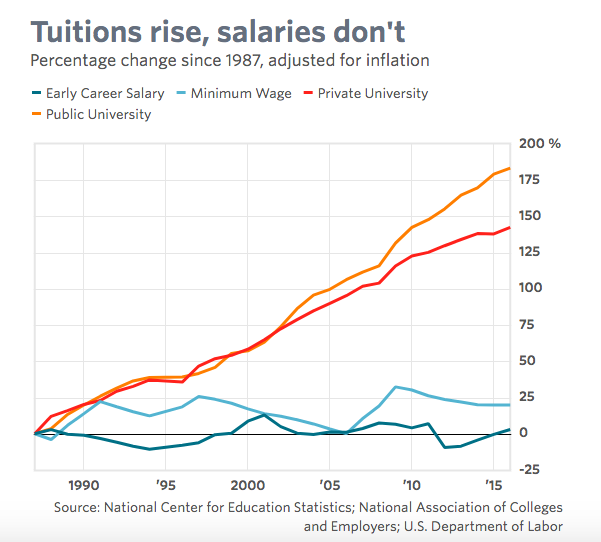

False belief 3#: College costs are rising so fast because the value of a college degree has risen so fast.

Note that on its face this isn’t really so much a justification for rising costs as a description of an economic basis for aggressive rent extraction from students and their families. But never mind that: the claim that the vaunted “degree premium” keeps going up and up obscures a problematic little fact about that rise: the rise in that premium — that is, the difference between what people with and without four-year college degrees earn — is almost solely a product of the decline in earnings of people without four-year college degrees, rather than any rise in earnings among those who have them.

The grim numbers:

Median hourly wage in 1979 and 2019, by educational attainment:

Bachelor’s degree

1979: $26.42

2019: $28.89

But wait . . . almost all of this pitifully small increase (recall that real per capita GDP doubled during this period) was piled up during the first half of this forty-year stretch of American economic history. Over the last twenty years the median hourly compensation of people with four-year college degrees has increased by a total of thirty-one cents, i.e. an average of just over a penny per year. Don’t spend that all in one place, millennials! Old Economy Steve says cut back on the double espressos marked with foam so you can buy a house in the suburbs, ya slackers.

Things are not quite so bad for people with advanced degrees — real median wages for them increased by 27.5% over this forty-year stretch, although here too the vast bulk of that gain was in the first twenty years of this period — which I suppose raises the question of why everyone hasn’t just gone to law school to collect their million-dollar wage premium (Full disclosure: there is a solution to this conundrum that I have noted in the margin of the manuscript). The flip side of all this is that wages have declined for people who have gone to college but either not gotten a degree, or not gotten more than a two-year associate’s degree, falling from $22.86 in 1979 to $20.00 in 2019. And the decline has been even sharper for those with high school diplomas or less — thus driving up the “degree premium” for several decades’ worth of college graduates whose own compensation has not actually gone up, even as the cost of their degrees has gone through the roof.

So why has the cost of college gone up so much, during an era when public subsidies for college have increased on a real dollar per student basis, overall per-instructor faculty compensation has declined sharply, and the degree premium has been transformed into essentially a statistical illusion, driven as it is by declining wages among non-graduates, rather than rising wages among those with degrees?

This is a complex question, and the mix of factors no doubt varies quite a bit across institutions, given the enormous differences that are found in such institutions when considering the more than 4,000 colleges and universities in the USA.

Nevertheless some major factors include:

(1) A huge increase in the amount of money that’s being spent on administration. While over the past 40 years the size of university faculties has increased more slowly than student enrollment, the sheer number of university administrators has increased far faster than the student population. On top of this, while compensation for faculty has stagnated or declined, as salaries for full time faculty have barely kept pace with inflation, and more and more formerly full time positions have been filled by low-paid adjuncts, compensation for upper administration has exploded.

Consider that a survey of the salaries of more than 700 American college and university presidents for the 1983-84 academic year found that the mean salary for this group was $63,501 — equivalent to about $157,000 35 years later. The single highest-paid university president at the time was making $118,000 in salary, that is, a little under $300,000 in constant dollars.

Today several dozen university presidents have seven figure annual compensation packages. (In 2017 the 20 highest-paid American university presidents had annual compensation packages that averaged $2.5 million). Overall, mean salaries of American university presidents have more than tripled in real terms over the past 35 years. And of course the salaries of presidents set the benchmark for the rest of the upper administrators at universities: there are now literally thousands of administrators at American universities making more, in constant dollars, than the highest-paid university president was making a generation ago.

(2) Closely related to (1), the upper administration of universities has become its own world, increasingly cut off from if not actively hostile to the faculties it is overseeing. As a rough generalization, prior to the 1980s or so, American universities were run by their own faculties: the top administrators were typically drawn from an institution’s faculty, and they would usually rotate back into regular faculty positions after a time.

Today, as an LGM commenter noted recently, universities are run by a class of professional university administrators, who move from school to school, very much as top corporate managers are always searching for the next promotion at the next company that will appear on their resumes. These are people who have abandoned academic life to become managers of massive bureaucracies, and their orientation toward their faculties is very much a severely hierarchical one, with all the latent and often overt hostility such relationships entails.

The career path of professional university administrators creates all sorts of perverse incentives from an institutional perspective, because the path to lateral advancement is always to spend more money: to “grow” the institution with more programs, more initiatives, more centers, more splashy hires of one kind or another, and in particular more shiny new buildings — the dreaded edifice complex — until the PUA moves on in a few years to the next institution, where the process can be repeated.

(3) All this, of course, means that the people running American universities have to be positively obsessed with increasing revenue, in order to pay for all this resume-enhancing growth. For example, the annual expendable endowment income of my alma mater, the University of Michigan, is now equivalent, in constant inflation-adjusted dollars, to what was the combined total annual expendable endowment income of all the nation’s 1,497 public colleges and universities when I was an undergraduate 40 years ago. (During this time Michigan’s endowment has grown from $115 million to $12.5 billion).

Spending levels at elite universities have become mind-boggling: in real dollars, the operating budgets of these places have nearly tripled over the past 30 years. Example: in 1989 Princeton had a total operating budget of $848 million in 2020 dollars: a sum which included a six million dollar operating deficit. In fiscal 2020 the school’s operating budget was $2.3 billion, which included an enormous operating surplus — the school had pulled in more than three billion dollars in total revenue during the previous fiscal year.

And all of this has a perverse trickle down effect, as schools further down the hierarchy spend sums that would have been considered absurdly profligate at HYPS a generation ago, but which are now considered the minimum necessary to maintain and enhance institutional “excellence” — a term which, like the other MBA buzzwords used compulsively now by top university administrators, is never actually defined in any concrete way, beyond spending more money this year than you spent last.

(4) It’s difficult to overstate the insidious effect that the creation and popularization of various ranking systems, that purport to formalize the American university hierarchy, has had on higher education in this country. It’s hard to remember now, but 40 years ago these things basically didn’t exist. Today, US News and the rest of its bastard progeny perform a very important practical function, which is to give university administrators a pseudo-empirical frame for constantly pursing an insanely negative sum competition for institutional status. Thus the competition to become a top X university — or more terrifyingly, to not cease to be one — requires ever-higher levels of spending: not least of all because these ranking systems actually use spending as a direct proxy for, um, “excellence.” (In other words, if two institutions are identical in all other respects, the one that spends more money to generate exactly the same results as the other will be higher ranked as between the two.)

(5) That competition also inflames the amenities race, in which the competition to secure top students — this means students with high test scores and grades — requires catering to the consumerist desires of people who have been socialized to think of college as, among other things, a kind of multi-year vacation at a well-appointed resort. Thus we “have” to build a lavish new student center, because all our competitors are doing that, which means we will fall behind in the all-important rankings if we don’t, because we will lose the “best” (meaning the most socially privileged) students to them, plus we won’t be spending as much money as they are, which in turn will also hurt us in the rankings, etc. etc. etc.

An especially expensive part of the amenities race is running a $100 million or $200 million per year athletic department, since it’s an article of unshakeable faith among upper university administrators that having successful football and men’s basketball teams is critical to competing for students. These two sports generate, at the Division I level anyway, enormous revenues. These revenues cannot be distributed to the (mostly Black) athletes who generate them, since that would destroy the ethos by which the battle of Waterloo was won on the playing fields of Eton, so that surplus revenue is then pumped into ever-more gargantuan athletic department budgets, featuring lots of administrators with six figure salaries — that of the athletic director now often hits seven figures — as well as lots of those shiny new buildings.

Again, it’s important to keep in mind that all this varies enormously across institutions: Harvard is not Michigan, which is not Western Michigan, which is not Kalamazoo Community College. Even so, the overall pattern of constantly spending more money on basically everything except the salaries of the people who do the teaching and the research is a general one.

Here’s the change in average revenue generated per student at American colleges and universities across the last 40 years, in constant inflation-adjusted dollars (1978 through 2018, which is the most recent year for which data are available):

Increase in per student revenue between 1978 and 1988: 18.4%

Increase in per student revenue between 1988 and 1998: 28.6%

Increase in per student revenue between 1998 and 2008: 12.1%

Increase in per student revenue between 2008 and 2018: 24.2%

Total increase in per student revenue at American colleges and universities during the New Gilded Age (1978-2018): 111.9%.

As to what to do about all this, answering that question requires first grappling with the very complex issue of what exactly higher education in the United States is supposed to be doing. That is a question for other posts.

But one thing we should not be doing is shoveling ever-larger sums of money, via cash tuition payments, $1.6 trillion in loans, $200 billion per year in public subsidies, and so on and so forth, into the hands of self-dealing university administrators, on the basis of what are increasingly preposterous claims about how under-funded their institutions are.

It is certainly arguable that American higher education should be funded at even higher levels than it is today. What is not defensible is the idea that we should give the people who have constructed the current system even more money, without also creating some better system of accountability in regard to how they are choosing to spend that money.

Sources:

Annual Digest of Education Statistics

Real Wage Trends, 1979 to 2019

College University Presidential Pay