U.S. Market Power and Regulatory Capacity

Abraham Newman and I have a new article in Foreign Policy on progressive policy and the use of American market power. We begin by discussing China’s ham-handed response to Houston Rockets general manager Daryl Morey’s tweet in support of Hong Kong democracy activists. The key point is that it fits a broader patten.

China routinely conditions market access, most notably by requiring foreign firms to partner in joint ventures with Chinese businesses. U.S. firms complain about how this requirement facilitates the theft of their intellectual property, but many simply cannot resist the allure of China’s large and growing domestic market.

The United States has a long history of doing the same. Washington used the carrot of market access—and the stick of withholding that access—to shape not only the international economy but also to pursue narrower economic and security interests. But, with a few notable exceptions—mostly in the domain of sanctions—the United States has let the instruments of market power atrophy.

[T]he U.S. market—clocking in at roughly $5.5 trillion this year—remains large and lucrative. The United States, however, is becoming less effective at using its market power to pursue crucial policy goals. Washington has, particularly under Republican leadership, degraded the regulatory infrastructure necessary to make the most of that market power. The result is that, in too many areas, Washington is starting to punch below its weight.

This last bit is, I think, one of the more unusual points that we make in the piece. The use of market power isn’t just about the carrots and sticks of access. It’s also about having the regulatory capacity (or “regulatory capital”) to effectively set global standards. This matters for progressives because domestic regulation and global standard-setting are key instruments for implementing their agenda.

To really affect the global economy through such standard-setting, a government requires the necessary regulatory expertise to identify and enforce market rules. Quality regulators understand the key pressure points for firms, as well as how they might try to evade penalties. These rules define not only the terms of competition but also exit options. The United States possesses both one of the largest markets in the world and extensive experience in the creation and enforcement of market regulations. This makes it a true market great power.

For the last 20 years, Washington has largely used this power to advance a neoliberal agenda of open markets, intellectual property protection, deregulation, and the use of sanctions to advance national security goals. As a result, Washington has usually played only a secondary role in addressing critical challenges, such as the threat posed by climate change, economic inequality, corporate tax evasion, and offshoring.

Indeed, as we argue:

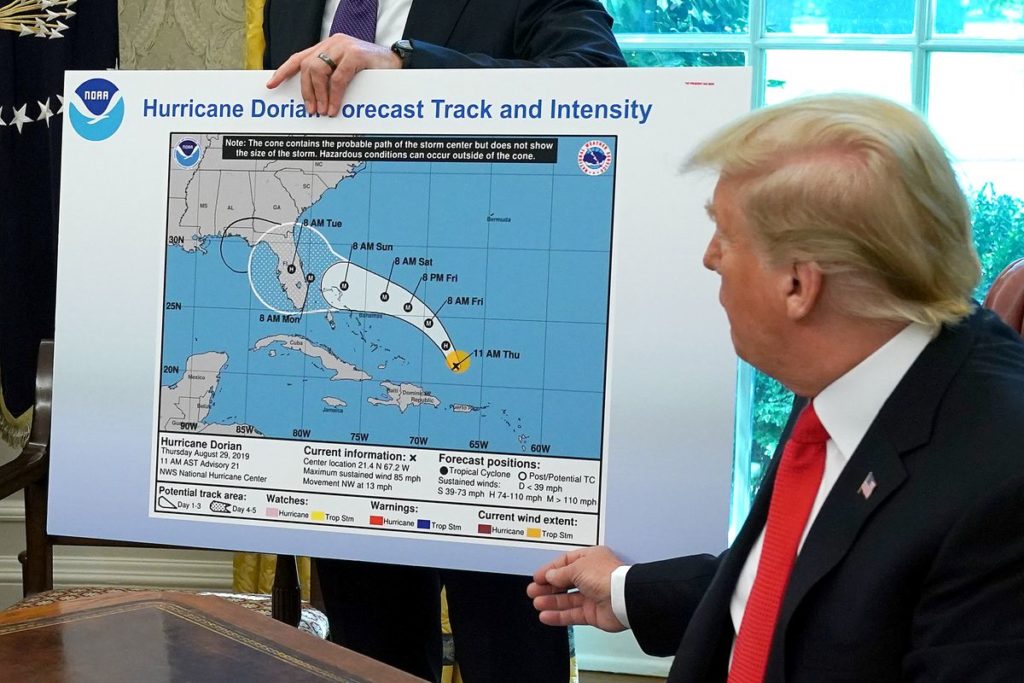

The rise of Chinese economic leverage, including through market power, is profoundly reshaping international politics. But one of the major threats to U.S. market power comes not from the relative decline of the overall economy when compared to China or other fast-growing countries, but instead from the Trump administration’s assault on American regulatory infrastructure. The Trump administration threatens U.S. regulatory expert capital through its efforts to hollow out American regulatory agencies to facilitate their (further) capture by corporate interests. More broadly, the administration has actively politicized regulatory agencies to provide cover for presidential and corporate interests, compromising those agencies’ ability to provide impartial oversight of market rules. Consider the U.S. Federal Aviation Administration’s attempt to keep the Boeing 737 Max flying—even as the plane was dropping out of the sky—or the infamous National Oceanic and Atmospheric Administration diagram that Trump modified with a sharpie to cover for a mistaken tweet about the path of Hurricane Dorian.

You can read the whole thing at Foreign Policy, including our discussion of, first, how combining US market power and regulatory standard-setting offers advantages over simply focusing on tariffs and trade and, second, we see evidence of a growing realization of this fact among liberal and progressive politicians.

When I was an undergraduate, a lot of what I learned in my basic economics and political economy classes was that neoliberal approaches to market externalities and failures were always superior to regulatory approaches. The latter created deadweight losses and risked regulatory capture.

Obviously, there are plenty of ways that we can use market-based interventions to tackle problems such as climate change. But, as we argue in the article, these concerns are often overblown; more important, they fail to adequately grapple with the politics of deregulation, whether domestic or international. Shockingly enough, it turns out the question is less “whether regulatory standards” and more “whose regulatory standards” and for “what purposes.” Realizing that, and adopting appropriate policies, will help serve not just liberal and progressive goals, but American economic interests in general.